Pay your Bills Online... Anytime

The Town of Chatham maintains an online payment gateway allowing convenient access for the payment of bills and fees. This gateway is ACI Payments, formerly Official Payments.

BILL PAY / MAKE A PAYMENT

Instructions:

- Visit www.OfficialPayments.com

- Choose Federal, State, Local or Education

- Choose State, Payment Entity and Payment Type

- Click Make a Payment

- Enter Amount and Choose Payment Method

- Read, Accept or Decline Terms*

- Enter Payment Details

- Confirm Information

- Submit

- Receive Confirmation Number**

* Service Fee will be shown prior to accepting or declining terms.

** Your Confirmation Number acts as your receipt. If you do not receive a confirmation number, then your payment was not processed.

Overview

| Summary of Fees and Tax Rates | ||

|---|---|---|

| Personal Property Taxes | $4.50 per $100 | |

| Real Estate Taxes | $0.25 per $100 | |

| Machinery & Tool Tax | $2.25 per $100 | |

| Business Licenses: | Retail | $0.20 per $100 |

| Wholesale | $0.05 per $100 | |

| Construction | $0.16 per $100 | |

| Minimum | $30.00 | |

| Peddlars | $50.00 | |

| Application: | Special Use Permit | $125.00 |

| Conditional Use | $125.00 | |

The Town Council sets the tax rates for personal property and real estate taxes. Water, sewer, and trash rates and fees are described elsewhere. The determination of personal property and real estate taxes is normally completed when the Town is preparing the total budget for the upcoming fiscal year.

Personal property is assessed as of January 1 each year by the Commissioner of Revenue, based on a pricing guide or a percent of the original cost. The assessment is based on vehicles in the taxpayer's possession and normally garaged, parked, or stored in the locality as of January 1.

The Code of Virginia provides for the assessment of real estate taxes based on fair market value as established by the governing body. All real estate property is subject to taxation unless it is specifically exempt.

Real Estate Taxes

Real property is assessed as of January 1 each year by the Commissioner of Revenue. Real estate is billed annually on December 5. A late payment penalty of 10 percent is added on December 6; interest at the rate of 6% a year is added beginning January 1. Failure to receive a tax bill will not relieve you of the penalty and interest applied to all past due bills. If there is a change of ownership, billing address, or any other change pertaining to your taxes, please notify the Treasurer's office.

We will forward a tax bill to a mortgage company if the company requests it in writing at least 60 days before the payment is due.

Taxpayers living in the Town of Chatham are required to pay Town and County Taxes as mandated by State Law.

Our Town and County levy personal property taxes on the following kinds of personal property: automobiles, trucks, motor homes, motorcycles, trailers, campers, farm machinery, boats, outboard motors, airplanes, and business personal property. This tax is assessed by the Commissioner of Revenue and paid to the Treasurer's Office.

Business License Tax

The Town Treasurer administers an annual business tax on businesses and professions located in or transacting business in the Town.

Licenses are issued on each calendar year with yearly renewals taking place during January. The tax is levied on all businesses and is based on the gross receipts of the previous calendar year. No business license will he issued if there are any outstanding personal property taxes. For further information, call the Town Treasurer at 434-432-8153.

Meals Tax

In accordance with Title 3 Chapter 3.06 of The Code of Ordinances of the Town of Chatham, a meals tax of 5% of the cost of meals and/or drinks is imposed for the Town of Chatham. This tax is due and payable by the customer at the time such items are purchased.

The Treasurer’s Office reminds you it is the duty of the proprietor of the establishment to register with the Treasurer’s Office and keep accurate records of all meals tax monies collected. The proprietor must deliver these monies along with a meals tax form to the Treasurer’s Office within twenty days of the last day of each calendar month.

When said taxes are reported and paid by the due date, the proprietor may deduct 2% of the tax amount due. If said taxes are not received in a timely manner, they are considered past due, and the 2% discount does not apply. Additionally, a 10% penalty for late filing is added to the taxes due.

To acquire the forms necessary for meals tax collection and reporting or for a complete copy of the Meals Tax Ordinance, please visit the Town Offices, at 16 Court Place, or contact us by phone or email. We are available at 434-432-9515 or by email atThis email address is being protected from spambots. You need JavaScript enabled to view it..

Dog Tags

All dogs four months old or older must have a County dog tag. These are sold all year to the County Treasurer's Office. You must provide proof of your dog's rabies vaccination. For more information, please call 434-432-7700.

Town Vehicle License Fees

Any person owning or leasing a motor vehicle, trailer or semi-trailer normally garaged, stored or parked in the corporate limits of the Town of Chatham on January 1 of each year will be accessed a Town of Chatham motor vehicle license fee. The cost of that fee is $40.75.

FOR ALL EMERGENCIES CALL 911

The Town of Chatham maintains its own Fire and Police departments. Town residents typically experience fast emergency response times and low crime. These departments can be contacted during regular business hours to address non-emergency questions or concerns.

Chatham Police Department

Non-emergency: (434) 432-8121

16 Court Place, PO Box 370, Chatham, VA 24531

Chief Randy Lawson

This email address is being protected from spambots. You need JavaScript enabled to view it.

Lieutenant Nathan Roach

Chatham Volunteer Fire Department

Non-emergency: (434) 432-1516

35 Depot Street, PO Box 192, Chatham, VA 24531

Chief Bobby Higgins

If you have a water or sewer emergency after the normal business hours of Monday through Friday 9:00am-5:00pm, please call Pittsylvania County Dispatch at 434-432-7931.

- Address: 16 Court Place, P.O. Box 370, Chatham, VA 24531

- Office Phones: (434) 432-8153; (434) 432-9515

- Fax: (434) 432-4817

- Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

- Office Hours: Monday-Friday, 9:00 a.m. - 5:00 p.m.

Nicholas Morris, Town Manager

Kelly D. Hawker, Clerk/Treasurer

Administrative Assistants

This email address is being protected from spambots. You need JavaScript enabled to view it.

This email address is being protected from spambots. You need JavaScript enabled to view it.

This email address is being protected from spambots. You need JavaScript enabled to view it.

The Mayor

The Mayor of Chatham serves a two-year term. In addition to representing the Town at official occasions and in the various business contracts that are required for the daily operations of a town, the Mayor serves as a point of contact to ensure that the Will of the citizens is expressed in Town decision-making.

The Mayor leads Town Council meetings and serves as the tie breaking vote only in the event of an impasse. Men and women of different ethnicities, classes, and occupations have served faithfully as Chatham's Mayor. Citizens may email the Mayor by clicking her name

Mayor AThis email address is being protected from spambots. You need JavaScript enabled to view it. was sworn in on December 12, 2022.

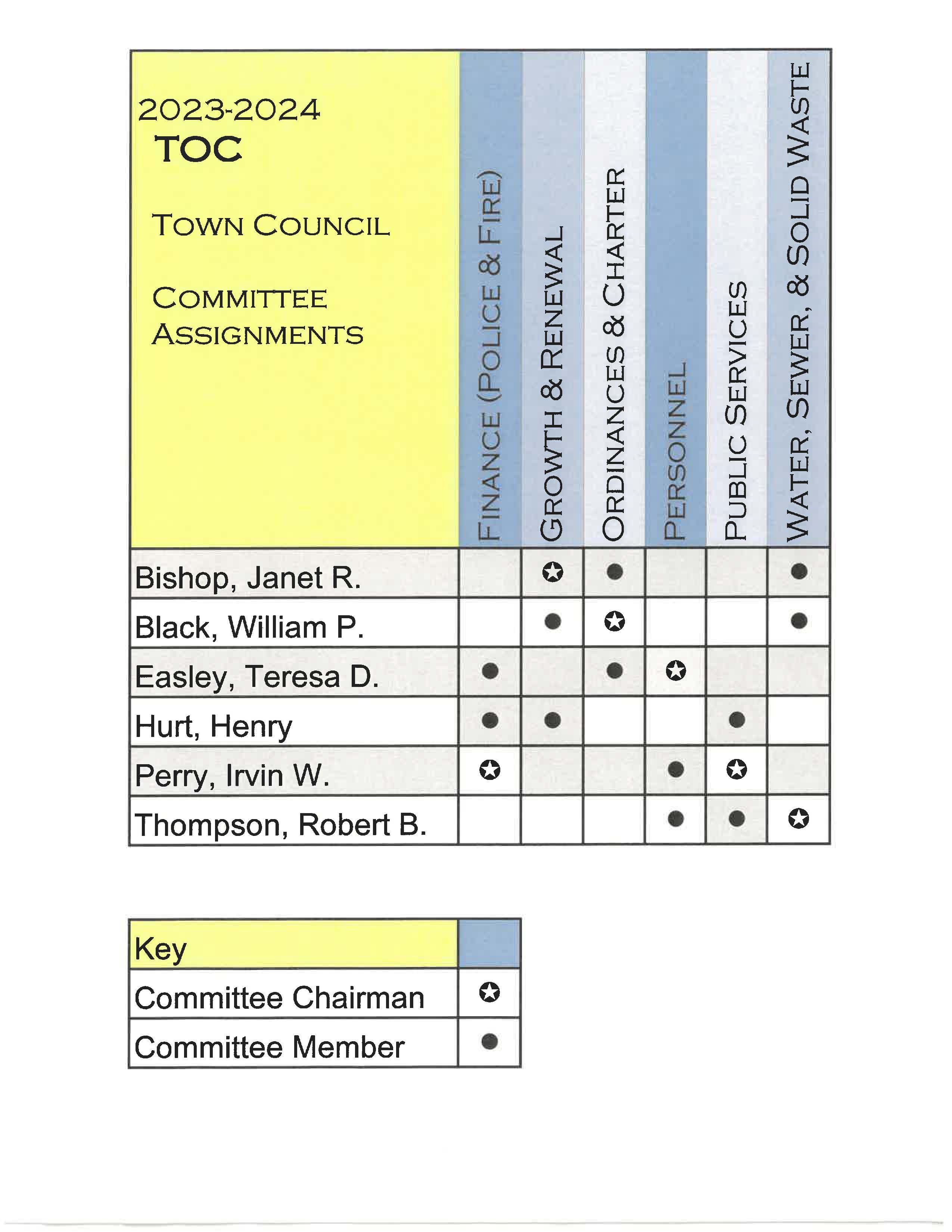

The Town Council

There are six voting members on the Chatham Town Council. The Council serves staggered four-year terms with three members up for election every two years. Council members are not recognized by national political affiliation. Citizens may email members of the Town Council by clicking their name.

2023-2024 Town Council Members

- This email address is being protected from spambots. You need JavaScript enabled to view it.

- This email address is being protected from spambots. You need JavaScript enabled to view it.

- This email address is being protected from spambots. You need JavaScript enabled to view it.

- This email address is being protected from spambots. You need JavaScript enabled to view it.

- This email address is being protected from spambots. You need JavaScript enabled to view it.

- This email address is being protected from spambots. You need JavaScript enabled to view it.

Upcoming Events